Fibonacci Retracements Analysis 24.10.2019 (AUDUSD, USDCAD)

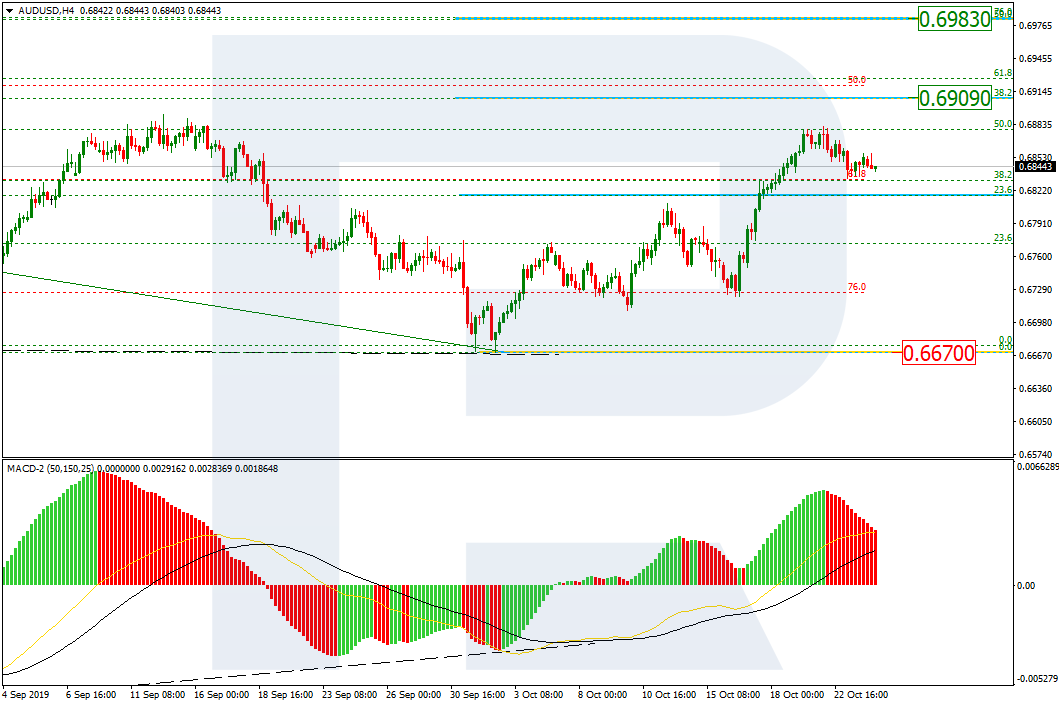

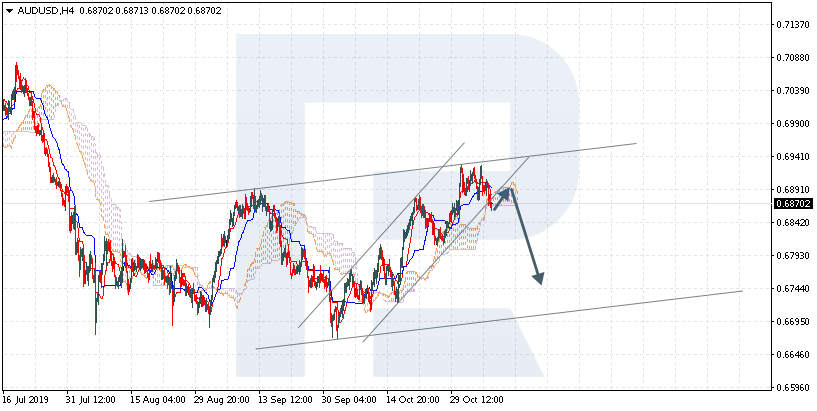

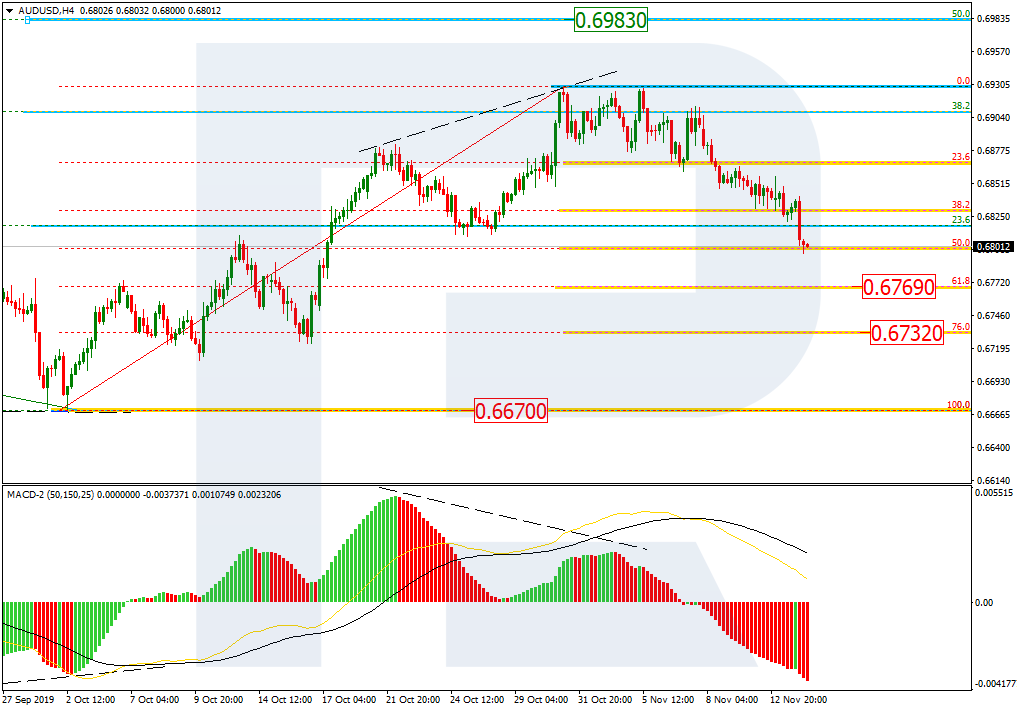

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, the convergence made the pair start a new growth; by now, it has fixed above 23.6% fibo. In the nearest future, AUDUSD may start a new pullback and return to this level. After the pullback, the correctional uptrend may continue towards 38.2% and 50.0% fibo at 0.6909 and 0.6983 respectively. The key support is the fractal at 0.6670.

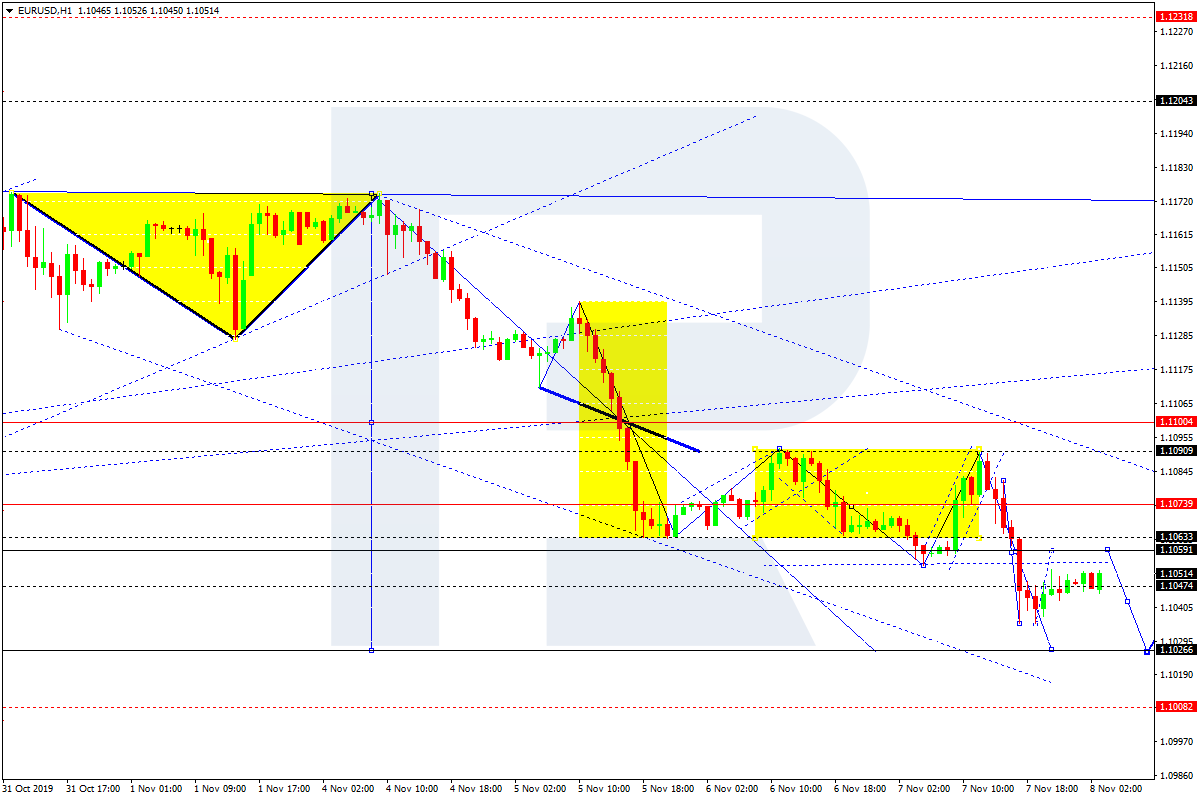

Read more - Fibonacci Retracements Analysis EURUSD, USDJPY

Comment