Originally posted by hardyli

View Post

Announcement

Collapse

No announcement yet.

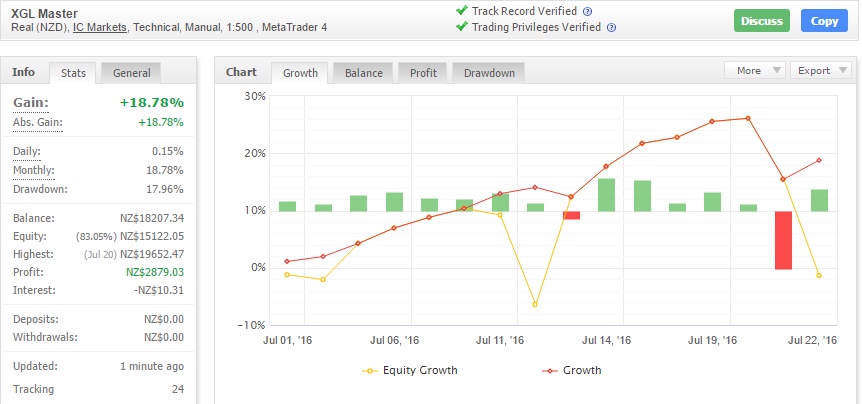

XGL High Returns Signal, PAMM & MAM Discussion

Collapse

X

-

Hmm I see a visible SL is set. I generally don't have anything against SL, but since you didn't use them before why now, when there is high risk of volatility and spikes could trigger our stops. NFP events have spikes in both directions. And to get hit with SL and minutes later see the price returns back to entry level would be bad. Wouldn't it be better if you place pending short orders in case price drops and ride it out? I hope we get out before, but it doesn't look promising and a loss of 60% will take a long time to recover.Last edited by oportunis; 08-04-2016, 10:32 AM.

Comment

-

i dont see the SL, how you seeing this, open trades myfxbook is locked and inside control panel it doesnt show,

personally i think 100 will continue to be supportive and we could even see a bounce back to 105, spec if we dip below 100 intervention could even occur

but then what do i know, nothing or i wouldnt need signals

Comment

-

You have to enable copy TP or SL in your simpletrader, than you should be able to see them. Stops are placed at 100.810 for first basket of trades and 100.630 for secound basket of trades. I think USD should gain strenght, but in news events such as NFP there are many spikes in both directions and those can trigger stops and price can still go up. That would be really bad to see price going up and we get hit with loss on a volatility spike.

Comment

-

such a tight SL for NFP just don't make sense.. this is not what I expected, hmm might disable the signal then from here an manage it manualy,

I do not see uj being below 100 for any serious time, and even if it is I expect it to come back above,

Comment

-

right. **** it ive taken my loss, reason being.. vendor was confident that we got upto second entry of basket trades.

well we got to this second basket entry early this morning ( i was asleep) and NO risk was taken of the table. (so with nfp tomorrow what was considered a waiting game I now tonight are viewing as a hold and pray situ)

if it was not for NFP I would of stuck in, so **** the loss, I just took a 30% hit to fight another day.

now "scott" I know you are in a lot more deep and me, and I know your also working your way out, best of luck their mate, what I will say is normally MOST times I have taken a loss like this the price then goes up to a BE situ and it ends up I take a loss for no reason! I can only hope my bad timing at taking losses remain true here so that you can exit this basket without big loss to yourself

best of luck with this,

would like to hear view on vendor why he didn't reduce risk when the biggest monthly event is tomorrow, for me this kind of behaviour ignoring big market events has cost me dearly in the past, thus why I will take that loss and come back next week fighting!

oh an normally I would stick it out a little longer an get closer till the event, but honestly I'm too jacked up on risk, like 60 pips down say around 100.70 is another 30% of my account in smoke, messed up with lot setting half way through this that has not helped

while I am confident that UJ will likely come back upto 105 at best or at least stay above 100 as mentioned earlier, I still need to be fully prepared to go down to 99.98 or lower before this plays out if UJ so wishes, and tbh to pull this off would require quite heavy hedges to be placed to survive the dip down

and to be perfectly honest I cannot be arsed to be so heavy invested during NFP Friday, (got enough grey hairs from fx already)

edit was used to place ****'s where neededLast edited by dupapa; 08-05-2016, 01:13 AM.

Comment

-

I would like to give an update on the current situation. First of all we are aware of NFP that is primarily the reason why we set SL of our basket of trades. It is to protect us from getting into any further damage. Should it reach, we will be cutting our trade at 60%. And reset.

It is unfortunate how this DD played out and we defintely have made some mistakes managing it. As I have mentioned in the FAQ, the old man can be stubborn and will live and die by his choices.

Should the SL hit, my accounts following at 0.5x will reach a 30% loss. What ever the outcome of this DD, we will learn from the mismanagement of this DD and improve on it.

I sincerely apologise to those that have lost money following our signal so far. This is why forex is a risky business, one mishap will take months to recover. Whatever the outcome of this basket of trade, we have faith in continue to make new equity highs in the future.

Kind regards,

Hardy

Sent from my MI 5 using Tapatalk

Comment

-

Yes I have sir. Believe me this is the main topic of our conversation each day. However what is done is done, and we will have to look forward. We will be making some changes to the way we manage risks in the future.Originally posted by DrcdpHave you had a stern word to your Dad regarding his risk management? I would sit him down, and lay down the law.

Sent from my MI 5 using Tapatalk

Comment

-

Hardy as I pointed out, your SL is too tight and could get hit because of volatility spike. It would be a big waste if we get hit with 60% loss and in next few minutes the price goes up to BE. On such events the price can easily jump 100 pips up and down and than goes back up. I hope this doesn't happen, but from my experience most of the time this occurs, that is why I don't trade big news releases. Can't you use pending orders to offset the risk in case data goes against us and we just switch to the shorts? In case we get hit with loss, it will take almost a year to get back to BE, will you offer some reduced price for existing users, so we don't get hurt on paying fees while recovering?

- Likes 1

Comment

-

What type of disciplinary action will you be taking against your Dad? Will it include time out in the naughty chair?Originally posted by hardyli View Post

Yes I have sir. Believe me this is the main topic of our conversation each day. However what is done is done, and we will have to look forward. We will be making some changes to the way we manage risks in the future.

Sent from my MI 5 using Tapatalk

Comment

-

Despite the current situation, I like your sense of humour in all this. It is definitely good to keep a positive attitude. The market will always be here and opportunities will always exist. Although a stop out will hurt, but we will live to fight another battle.Originally posted by Drcdp

What type of disciplinary action will you be taking against your Dad? Will it include time out in the naughty chair?

I would have to send him to the naughty corner for a week. And get him to write out a list of actions before continuing again. No candy for a week!

Sent from my MI 5 using Tapatalk

Comment

-

I followed with fixed 0.01 lots (0.10x risk setting) to get a feel for the style. As mentioned previously I hadn't planned to stick around for much longer. The last non stop buying on USDJPY was another example of what I didn't like and I had to intervene with some 0.35 lot scalps held over weekend and pure luck to get that needed retracement to close all of XGL buy positions.Originally posted by HedgeBitcoin View PostI am following this provider and I do not recommend for the following reasons.

1. Counter trend scalps, Always trying to catch the intraday reversals.

2. Holds losses for very long time ( tries to offset the losses with new scalps , similar to fx viper style)

3. Begins hedging or trading in opposite direction after accepting a 20-30% open drawdown.

4. Small pip gains, I followed with ICMarkets and since the signal is Fast, the follower gets less pips overall.

5. Pip Expectancy is 2.5 Pips. - commission - slippage.

After 1 month , no profit, a lot of risk and a lot commission paid to the broker

https://i.gyazo.com/0f4543eda609221d...c80af763e9.png

Since the trader is suppose to be a manual fighter maybe he will learn and ease up on this counter trend scalping because its pure risk without some stoploss in place. Until then, keep risk settings low and always have some extra funds to intervene and fight your own battle.

HedgeBitcoinLast edited by HedgeBitcoin; 08-05-2016, 07:02 AM.

Comment

-

Hi Oportunis,Originally posted by oportunisHardy as I pointed out, your SL is too tight and could get hit because of volatility spike. It would be a big waste if we get hit with 60% loss and in next few minutes the price goes up to BE. On such events the price can easily jump 100 pips up and down and than goes back up. I hope this doesn't happen, but from my experience most of the time this occurs, that is why I don't trade big news releases. Can't you use pending orders to offset the risk in case data goes against us and we just switch to the shorts? In case we get hit with loss, it will take almost a year to get back to BE, will you offer some reduced price for existing users, so we don't get hurt on paying fees while recovering?

While you are right that this may occur, but this is the decision my father has made. We would rather protect our account and if SL hit get this DD over with and regroup and make improvement. If we get out of this DD, either way we will make some crucial changes to the way this account is traded.

If SL is hit, for those subs that would like to stay, can email me and we can work out something.

Sent from my MI 5 using Tapatalk

Comment

Comment